Have you ever wondered how technology could revolutionize banking and financial services?

Fintech is a rapidly emerging field with the potential to completely change the financial services industry. We’ll explore the potential of fintech to transform the banking and financial sectors and show you how to take advantage of this opportunity.

Fintech is revolutionizing the financial service industry, and its potential is enormous. Although it is still in its infancy, it has already disrupted traditional banking, allowing customers to conduct banking transactions through their mobile phones, computers, and other devices.

The fintech industry has exploded in recent years. According to Adroit Market Research, the Global fintech industry’s market share was worth over $110.5 billion in 2020 and is expected to be worth over $699.5 billion by 2030. These numbers represent a huge opportunity for businesses looking to capitalize on this growing trend.

Introduction to Fintech: What is Fintech and How Can it Change Banking and Financial Services?

The rise of fintech within the banking and financial industry has provided an opportunity for innovative products and disruptive technologies. Fintech is an emerging industry that deals with the latest technology, processes, and systems used to deliver financial services.

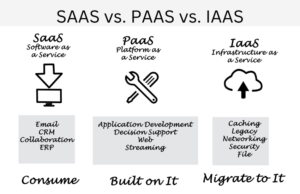

It incorporates digital, mobile, and cloud-based solutions that are designed to increase customer service across all financial service domains. Furthermore, it has transformed the way in which individuals, firms, businesses, and governments interact with banking services by increasing customer satisfaction through the application of advanced technology solutions.

Fintech is changing the way the bank and financial companies sector works by providing more efficient, secure, and cost-effective products and services. It has the potential to improve access to financial services, increase financial inclusion and create more transparency.

Fintech is changing the banking and financial sector. Fintech is enabling the industry to offer more secure and convenient ways to store, manage and access financial information. The introduction of digital banking and digital payments has made it easier for customers to access and manage their finances.

For example, digital payments are becoming more popular as they provide a faster and more secure way to make payments. Additionally, customers now have access to a wide range of financial services and products, such as online banking, insurance, and investing, via mobile and web applications.

Fintech is also making the banking and financial sector more efficient by streamlining processes. This includes the use of automation and artificial intelligence to process data more quickly and accurately. In addition, blockchain technology is being used to provide a secure and transparent way to store and transfer data. Moreover, fintech is making data-driven decisions more accurate, enabling more informed decisions to be made.

Fintech is pushing banks to use more digital technologies to give their customers better experiences. This includes apps for mobile banking and tools like Robo advisors. Robo advisors are a type of computer program that can give personalized advice about managing money at a lower cost. There are also companies that specialize in lending money to people who could not get a loan from a bank because their credit score or income didn’t meet the bank’s requirements.

Banks are now offering new services that can help customers manage their investments and cash flow. These services can help customers grow their investments and make better financial decisions. The services also help banks by reducing their administrative costs. This means that banks can spend more time helping customers who need individual attention.

In order for banks and financial institutions to capitalize on this growing trend, they must innovate alongside current customers’ needs whilst addressing underlying structural challenges associated with legacy institutions’ physical infrastructure challenges posed by legacy technology segmenting them from modernizing; merely relying on existing models will no longer be enough if they want a piece of the pie known as today as FInTech (Financial Technology).

Banks need to stay ahead of the trends and keep up with what people want. One way to do this is to partner with FinTech startups that come up with new ideas for user experience. This could be done by integrating their updates into the existing ecosystem through API partnerships. This would help banks stay ahead of the competition and give them the ability to quickly scale up.

Understanding the Current State of Fintech: Identifying Gaps and Opportunities

The potential of fintech, especially in the banking and financial services sector, is just beginning to get explored. Over the last few years, players in this sector have already implemented several digital transformation initiatives to improve their capabilities, but further opportunities remain that have yet to be capitalized on.

Before looking ahead to the future of fintech, it is important to first understand the current state of the sector today.

What potential opportunities and gaps exist? How has digital innovation been used so far? Which strategies are still needed? By recognizing existing trends and issues within the industry, organizations can begin to figure out how best to move forward with their own fintech journey.

This includes understanding the existing landscape of fintech companies, the types of services and products being offered, and the regulatory landscape that affects the industry.

In order to gain a better understanding of the current state of fintech, it is important to evaluate the existing players in the market. This includes looking at the types of companies that are offering products and services, the technologies they are leveraging, and the regulatory environment.

Additionally, it is important to consider the customer base, the use cases being addressed, and the potential for growth. By evaluating the current state of the industry, it is possible to identify areas of opportunity and potential gaps, as well as any potential risks that may be associated with the industry.

By understanding the current state of fintech, businesses can better position themselves to capitalize on opportunities, as well as stay ahead of potential risks and do better risk management. Identifying existing gaps and opportunities in the market can help to inform strategic decisions and create a more robust, profitable, and secure financial ecosystem.

In terms of opportunity, one key area that many companies are focusing on is customer centricity. The banking and financial services sector has historically operated with customers as passive recipients of services rather than empowered participants in creating value.

With digitization now paving the way for enhanced customer experiences across all stages of a product or service lifecycle – including engagement through digital channels like web portals and mobile apps – businesses are taking actions such as leveraging analytics insights and AI/ML algorithms to better customize offerings for customers in ways that maximize customer satisfaction.

Yet another opportunity lies with genuinely open and collaborative partnerships between banks and external providers such as startups or fintech companies where both parties share resources, skillsets, and even risks in order to jointly focus on problem-solving innovation regardless of who owns or controls it.

By partnering with outside experts who specialize in areas such as data science or blockchain technology development, traditional banks can gain access to technologies they might otherwise not have had while simultaneously tapping into ground-breaking ideas pertinent and specifically tailored to the needs of their customers.

Companies need to be ready for change and make sure they are up to date with the latest developments. To do this, they need to look for any new opportunities out there and identify any gaps in their current strategies. For example, if they don’t have the right people for the job or the right resources, they need to figure out how to get there. They need to make sure they follow the right regulations too. All of this will help them be prepared for anything in the future and make sure they’re in the best position possible.

Exploring New Strategies for Capitalizing on Fintech: Leveraging Existing Fintech Solutions

Fintech is already shaking up the banking and financial services industry, but this rapidly evolving space can be challenging for many organizations. To capitalize on the potential of fintech, businesses need to explore different strategies for leveraging existing fintech solutions.

Organizations are increasingly investing in cutting-edge technology such as artificial intelligence and machine learning, sophisticated authentication mechanisms, and cyber security protocols to increase efficiency and enhance customer experience. This means that traditional banks must consider partnering with fintech startups in order to stay competitive. By leveraging existing fintech solutions, institutions can tap into cutting-edge technology and provide their customers with a superior user experience.

Organizations should also pay attention to venture capital investors, as they often hold key insights into emerging trends within the industry, such as regulatory changes, technological advances, or mergers/acquisitions that might affect the bottom line or operations of the firm when choosing which fintech companies to invest in. Additionally, they can help identify new investment opportunities that could prove invaluable in the long term.

In addition to tapping into existing resources and exploring venture capital investments, organizations seeking to capitalize on fintech should consider developing their own proprietary technologies in order to better meet market demands for innovation, cost efficiency, and Transparency/Security compliance needs.

Companies would benefit from forming strategic partnerships with established players within the market, such as financial institutions or software providers, who have access to advanced technologies such as distributed ledgers (blockchains) in order to build out a customized Fintech infrastructure tailored towards their specific needs.

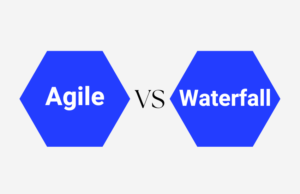

By taking an agile approach which allows the company’s strategists time to experiment with different technologies, firms can create more tangible results whilst at the same time staying ahead of competitors in terms of innovation within both customer satisfaction capabilities as well as security protocols necessary for operating securely online/cyberspace environment arenas.

Overall, the exploration of new strategies for capitalizing on fintech is essential if organizations want to be successful within this lucrative sector. Through following best practices by leveraging existing solutions and engaging in strategic partnerships alongside innovating through proprietary technology builds, they will be able to position themselves within a superior market position resulting in stronger brand recognition & sustained healthy profit margin returns, all while helping customers feel secure & satisfied along every step of their financial service journey requirements & desires!

Developing a Comprehensive Plan for Adoption: Assessing the Risks and Benefits of Fintech

Financial technology (fintech) is transforming the financial services industry around the globe. The potential of fintech to create new opportunities and revolutionize financial services, from banking to payments and investments, is immense. To capitalize on these opportunities, companies must develop a comprehensive plan for the adoption of fintech that thoroughly assesses the risks and benefits associated with this rapidly evolving technology.

Consider the Current Financial Environment

To develop a comprehensive plan for adoption is to assess the current financial environment and identify the specific areas where fintech could help improve existing services and processes. This can involve researching the latest advances in Fintech technology, understanding the current regulatory landscape, and exploring new opportunities for collaboration with other financial institutions. A thorough understanding of the current financial environment will help inform the decision-making process and ensure that any risks associated with the adoption of Fintech technology are minimized.

Assessing the Risk

When planning for fintech implementation, it’s important to assess both short-term risks and long-term rewards. In terms of short-term risk management, organizations should closely monitor their system performance and consider whether they have adequate safeguards in place should any issues arise. A risk management approach to assessing fintech should also consider how integration efforts might impact traditional systems, what kind of error detection capabilities are present in the system, as well as how data security is handled and monitored over time.

Consider the Potential Benefits

Organizations adopting fintech should also be cognizant of the long-term benefits that tech integration can bring.

For example, how could operations be streamlined through automation or process reengineering? What can be done to enhance customer experience? How could big data analytics help create better insights into customer behaviors? How could future products or services benefit from increased efficiency brought by fintech?

Taking a strategic approach to assessing these potential opportunities helps organizations understand how their investments in fintech can ultimately help drive innovation and growth moving forward.

Ultimately, building a comprehensive plan for implementing fintech requires sound risk management coupled with strategic foresight into the potential value that advanced technology can bring to a company’s business model. Understanding both the risks and rewards associated with technological advances allows companies to capitalize on digital transformation opportunities that can keep them competitive while managing any uncertainty or disruption along the way.

Organizations adopting fintech should also be cognizant of the long-term benefits that tech integration can bring.

For example, how could operations be streamlined through automation or process reengineering? What can be done to enhance customer experience? How could big data analytics help create better insights into customer behaviors? How could future products or services benefit from increased efficiency brought by fintech?

Taking a strategic approach to assessing these potential opportunities helps organizations understand how their investments in fintech can ultimately help drive innovation and growth moving forward.

Ultimately, building a comprehensive plan for implementing fintech requires sound risk management coupled with strategic foresight into the potential value that advanced technology can bring to a company’s business model. Understanding both the risks and rewards associated with technological advances allows companies to capitalize on digital transformation opportunities that can keep them competitive while managing any uncertainty or disruption along the way.

Organizations adopting fintech should also be cognizant of the long-term benefits that tech integration can bring.

For example, how could operations be streamlined through automation or process reengineering? What can be done to enhance customer experience? How could big data analytics help create better insights into customer behaviors? How could future products or services benefit from increased efficiency brought by fintech?

Taking a strategic approach to assessing these potential opportunities helps organizations understand how their investments in fintech can ultimately help drive innovation and growth moving forward.

Ultimately, building a comprehensive plan for implementing fintech requires sound risk management coupled with strategic foresight into the potential value that advanced technology can bring to a company’s business model. Understanding both the risks and rewards associated with technological advances allows companies to capitalize on digital transformation opportunities that can keep them competitive while managing any uncertainty or disruption along the way.

Implementing Fintech Solutions: Creating a Process for Adopting and Integrating Fintech

Fintech is an important disruptive innovation that can significantly transform banking and financial services. Adopting and integrating fintech solutions can revolutionize the way industries operate, providing a reliable, fast, and secure platform to deliver services quickly and cost-effectively.

However, when it comes to implementing fintech solutions in existing processes, organizations must keep certain things in mind. Business entities must develop a streamlined process for acquiring new technologies and integrating them with existing IT frameworks while minimizing risks associated with data security, privacy concerns, compliance mandates, etc.

To capitalize on the potential of fintech to revolutionize banking and financial services, organizations should first analyze their current operational infrastructure from a technical and business perspective by objectively assessing their IT capabilities. Next, organizations should evaluate vendor solutions such as blockchain applications or artificial intelligence (AI) models to determine which would best fit their needs. In addition, to assess the technology, companies must ensure that the vendor’s customer support team is experienced in working with its platform.

Companies must prioritize data security during the integration process by conducting risk analyses to evaluate potential threats associated with introducing fintech products or services into existing system architectures. Security measures should also be taken to protect personal data, such as customer payment information or confidential records, from unauthorized access through encryption algorithms or tokenization protocols – as applicable – so that customer information remains secure throughout the integration process.

Finally, after identifying suitable third-party vendors with advanced technology solutions that meet business requirements while offering top-notch customer service alongside robust security procedures, organizations should create a comprehensive roadmap outlining steps taken throughout various stages of adoption including design specifications documentation & testing procedures before putting any changes into production use.

Analyzing the Impact of Fintech: Examining the Effects of Fintech on the Banking and Financial Services Industry

The digital revolution has profoundly affected the banking and financial services industry. Fintech, or “financial technology”, is a transformative technology that has emerged in recent years in response to rapidly changing customer needs and trends.

Financial institutions of all sizes leverage these technologies to differentiate their offerings to gain a competitive advantage while reducing costs, risks, and complexity.

The impact of fintech on the banking and financial services industry is far-reaching and continues to grow at an unprecedented rate of 20.3% CAGR. This can be seen through the increasing use of cloud computing, digital payments, mobile banking services, artificial intelligence (AI)-driven decision-making tools, fraud detection systems powered by data analytics, and a variety of other innovations designed to integrate with existing structures.

Fintech offers a wide range of possibilities for innovation that financial institutions can use to drive operational efficiencies— from streamlining processes to securing digitally stored data more reliably.

These innovative options also provide customers with enriched service options available anytime, anywhere; personalization options; improved user experiences; enhanced security measures; and faster processing times compared to more traditional models.

In addition, fintech creates new opportunities for businesses beyond the banking sector to increase convenience for customers by improving access to ATMs that allow cash withdrawals without using cards or additional applications integrated into regular web pages or social media channels such as Facebook or Twitter.

It also enables companies in other industries, such as retail or hospitality sectors, much easier access when it comes to implementing payment portals on their websites or apps as well as facilitating omnichannel experience through presenting accessible solutions enabling cross-channel payment processes.

The successful adoption of fintech solutions will benefit banks and industries that depend heavily upon secure payment processing services, such as those provided by banks or other FSIs (financial service institutions).

By taking advantage of digital innovation, the industry is transforming into one that will adopt technology into average practice faster than was considered possible just a few short years ago.

Making it much easier for organizations both large and small scale alike – looking for modern financial platforms to more effectively capitalize on their current opportunities within the sector.

Looking to the Future: Anticipating the Potential for Further Disruption and Transformation

Given the rapidly transforming landscape of financial services, staying ahead of the curve is essential for businesses that want to remain competitive. To capitalize on the opportunities presented by fintech, it is important to understand where the industry stands today and where it’s heading in the future.

Cryptocurrency has emerged as an important player in fintech, and its potential for disruption is enormous. By allowing users to bypass the traditional financial system, cryptocurrency presents a unique opportunity for entrepreneurs and enterprises. Additionally, digital currencies such as Bitcoin/ETH have brought up a new generation of smart contracts that can facilitate business and customer financial transactions.

The rise of open banking/data sharing initiatives such as Open Banking has changed how banks interact with customers. Banks must now make customer data more accessible while safeguarding against fraud.

This shift has allowed third-party companies to become more involved with conventional financial services by creating new products that link existing bank accounts with other digital services like receipt management and budgeting apps.

In the coming years, we can expect to see a greater focus on artificial intelligence (AI) and machine learning and an increased use of blockchain technology. AI and machine learning will enable greater personalization and customization of financial services, while blockchain technology will facilitate the secure and efficient transfer of data and assets.

Additionally, the increasing prevalence of cloud computing will enable financial institutions to access data in real-time and provide faster, more reliable services.

Predictive analytics could offer personalized advice in areas such as investment strategy and tax planning to better meet customer needs. Additionally, advancements like Open Banking should facilitate even further integration between technology and financial services; this could help bridge gaps between stakeholders like merchants, banks, and consumers, resulting in better overall service levels across all parties involved.

Ultimately, organizations should continually reevaluate their strategies to take advantage of available technology when transitioning from legacy systems toward a new era of digital banking innovation.

Conclusion

The potential of fintech to revolutionize banking and financial services have been seen many times over recent years. The question for organizations is not whether or not to use it but how best to capitalize on this opportunity. For organizations to remain competitive, they must strive to stay ahead of the curve and understand how to utilize fintech solutions effectively.

Fintech companies are now developing innovative products and services that promise increased efficiency, reduced costs, enhanced security, and convenience for banking customers. Many established companies have already adopted these technologies and are reaping the benefits. As a result, organizations seeking to remain competitive should ensure they are effectively leveraging new fintech capabilities and understanding and implementing the right strategies to stay one step ahead of their competitors.

Organizations should also be aware of customer feedback about their services and customer expectations when using technological solutions such as mobile apps, online banking platforms, data analytics tools, and more. Ultimately, organizations should continue innovating to leverage emerging technologies to take advantage of the potential that fintech offers while ensuring they stay ahead of their competitors and meet the demands of modern customers.

It is clear that fintech will continue to significantly impact the financial industry. The speed and efficiency of these new technologies have the potential to revolutionize the sector and create a whole new world of possibilities for businesses and consumers.